CORPORATE

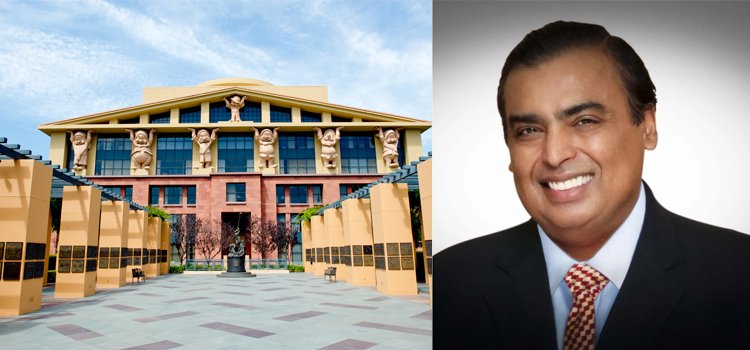

Reliance, Walt Disney seal $8.5-billion deal to form biggest entertainment giant

- IBJ Bureau

- Feb 29, 2024

The country’s largest conglomerate, Reliance Industries, and Walt Disney on Wednesday announced the merger of their India TV and streaming media assets, creating an $8.5-billion entertainment juggernaut far ahead of rivals in the world’s most populous nation.

Reliance, led by Asia’s richest man Mukesh Ambani, will inject $1.4 billion in the merged entity, with the company and its affiliates holding a more than 63 per cent stake, with Disney owning the rest, the companies said in a joint statement.

For Disney, the merger follows its long-drawn struggle to arrest a user exodus from its bleeding India streaming business and financial strain caused by billions of dollars in Indian cricket rights payments. Disney’s is another example of how foreign businesses can struggle to grow in India.

The merger values the India business of the US entertainment giant at just around $3 billion, far lower than the roughly $15 billion valuation when Disney had acquired it as a part of its Fox deal in 2019. A senior Disney source said that the value of the company’s India assets was closer to $4.3 billion, when accounting for synergies.

Together, the Reliance-Disney merged entity will have 120 TV channels and two streaming platforms, plus TV and streaming cricket rights for key tournaments in a country with a crazy following for the sport.

“The combined entity will create a sports behemoth in India,” said Jinesh Joshi, an analyst of Prabhudas Lilladher. “This merger will give Reliance great bargaining power when it comes to negotiating advertisement contracts .... For Disney, coming together with a bigger player, in terms of (financial) pockets, will give it a cash cushion,” he added

Report By

View Reporter News