ECONOMY

RBI keeps Repo Rate unchanged at 6.50% for 7th time in a row to fight inflation

- IBJ Bureau

- Apr 06, 2024

The Reserve Bank of India (RBI) has decided to keep the key Repo Rate unchanged at 6.5 per cent as its focus remains on bringing inflation under control.

This is the seventh straight time that the central bank’s six-member Monetary Policy Committee (MPC) has decided to keep the key policy rates unchanged.

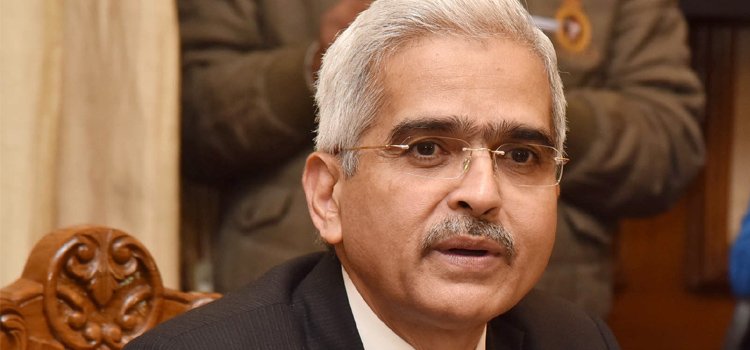

RBI Governor Shaktikanta Das said that the MPC voted in favour of keeping the key lending rates unchanged.

“After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the Reserve Bank MPC decided by a majority of 5 to 1 to keep the policy Repo Rate unchanged at 6.50 per cent,” Mr Das said.

It may be noted that the Standing Deposit Facility (SDF) also remains unchanged at 6.25 per cent and the Marginal Standing Facility (MSF) at 6.75 per cent.

The decision is largely in line with what economists had predicted.

Mr Das said in his monetary policy statement that the priority of monetary policy continued to be the achievement of the 4 per cent inflation target amidst robust growth.

He also highlighted the need for the monetary policy to maintain an actively disinflationary stance at this stage.

Upasna Bhardwaj, the chief economist of Kotak Mahindra Bank, told news agency Reuters that the MPC maintained status quo on expected lines. “While low core inflation provides comfort, the uncertainty on food inflation remains a worry,” she said.

“Further, the higher US yields, higher oil prices and other commodities, along with possible delay in Fed’s rate easing cycle will keep the MPC wary. Accordingly, we do not see much scope for any rate easing until the second quarter of FY25,” Ms Bhardwaj added.

Report By

View Reporter News