ECONOMY

RBI leaves Repo Rate unchanged for the ninth time in a row to drive growth

- IBJ Bureau

- Aug 09, 2024

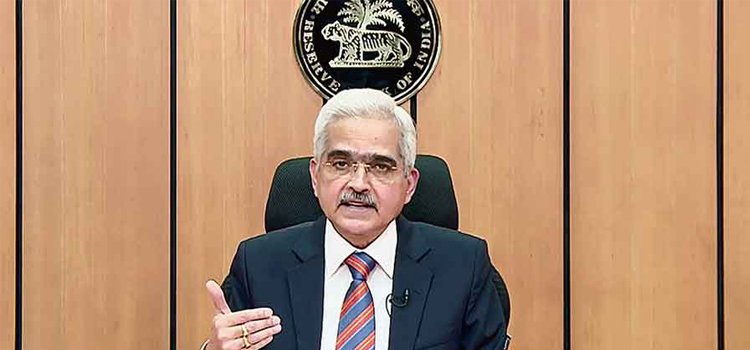

The Reserve Bank of India (RBI) on Thursday kept key policy Repo Rate unchanged at 6.5 per cent for the ninth consecutive meeting. The central bank continued to maintain a balance between accelerating economic growth and keeping inflation under control.

RBI Governor Shaktikanta Das said that the Monetary Policy Committee (MPC) had decided by a 4:2 majority to keep the Repo Rate unchanged as inflation had risen above 5 per cent and was still above the targeted level of 4 per cent.

He said that inflation after having eased to 4.8 per cent in April and May had risen to 5.1 per cent in June on the back of “stubbornly” high food prices.

Mr Das said that the country’s inflation rate was expected to come down in the third quarter of the current financial year.

He also said that domestic growth was resilient, supported by steady urban consumption. The MPC determined that it was crucial for monetary policy to remain consistent while closely monitoring inflation. The committee emphasised maintaining a primary focus on inflation to support sustained economic growth.

Mr Das also said that there “is a convergence” between the RBI’s monetary policy decision and market expectations.

The RBI has decided to stick to the “withdrawal of accommodation” policy stance. Monetary policy is considered to be “accommodative” when it aims to make more money available in the banking system to spur economic growth and create more jobs.

The RBI had last changed rates in February 2023, when the Repo Rate was hiked to 6.5 per cent. The RBI had raised rates by 2.5 per cent between May 2022 and February 2023, after which they have been kept on hold to support economic growth despite inflationary pressures in the past.

Report By

View Reporter News