ECONOMY

GST Council approves two-tier regime of 5% & 18%, sin, luxury goods taxed at 40%

- IBJ Bureau

- Sep 04, 2025

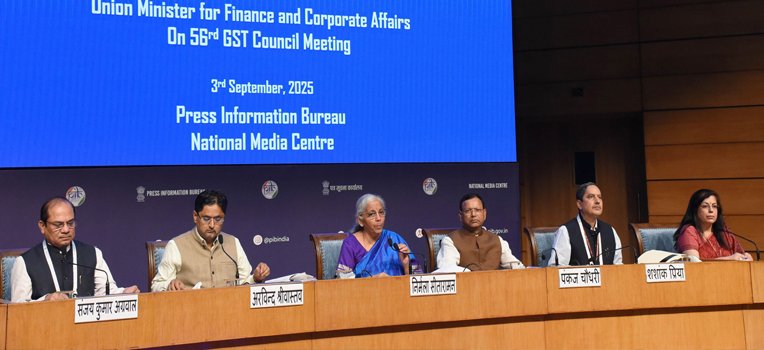

The 56th meeting of the GST Council, chaired by Union Finance Minister Nirmala Sitharaman, has approved rationalisation of GST rates and abolished the 12 and 28 per cent slabs. The new slab structure will come into effect from September 22, the first day of Navaratri.

The GST Council has cleared a two-tier tax structure with rates of 5 and 18 per cent, along with a new 40 per cent slab for sin and luxury goods. However, tobacco products and cigarettes will continue to attract 28 per cent GST and compensation cess till loans are repaid by the States.

“These reforms have been carried out with a focus on the common man. Every tax on the common man’s daily-use items has gone through a rigorous review and in most cases the rates have come down drastically. Labour-intensive industries have been given good support. Farmers and the agriculture sector, as well as the health sector, will benefit. Key drivers of the economy will be given prominence,” Ms Sitharaman has said after the GST Council meeting.

As a part of the restructuring, 175 broad items of mass consumption, including milk, paneer, snacks and bread, will become cheaper. Goods such as hair oil, toilet soaps, shampoos, toothbrushes, tableware and kitchenware will now fall under the 5 per cent bracket.

Items like UHT milk, paneer, chhena and all kinds of Indian breads, will move from 5 per cent to nil. Spectacles will now be taxed at 5 per cent.

Around 99 per cent of items currently taxed at 12 per cent will now fall under 5 per cent, including natural menthol, fertilisers, handicrafts and several labour-intensive sectors such as marble and granite blocks. Additionally, 33 life-saving drugs and medicines will move from 12 per cent to nil.

Nearly 90 per cent of goods currently taxed at 28 per cent will shift to 18 per cent. This includes air-conditioning machines, televisions above 32 inches – with all TVs now under 18 per cent – dishwashing machines, cement and small cars and motorcycles below 300 cc.

Automobiles such as small cars up to 350 cc, buses, trucks, ambulances and auto parts will also move to the 18 per cent slab. Dishwashing machines and bikes will remain in the 18 per cent category.

The inverted duty structure has also been corrected, with man-made fibre moving from 18 to 5 per cent and man-made yarn from 12 to 5 per cent.

The council has also approved a new 40 per cent GST rate for sin and super-luxury goods. The higher slab will apply to items such as paan masala, tobacco, cigarettes, bidis, aerated water, carbonated and caffeinated beverages, as well as luxury items like motorcycles exceeding 350 cc, yachts and helicopters.

Report By

View Reporter News