ECONOMY

RBI keeps Repo, Reverse Repo Rates unchanged, cuts FY22 GDP growth rate to 9.5%

- IBJ Bureau

- Jun 04, 2021

The Reserve Bank of India (RBI)’s Monetary Policy Committee (MPC) kept key policy rates unchanged on Friday, citing persisting uncertainties on the economic front due to COVID-19 pandemic.

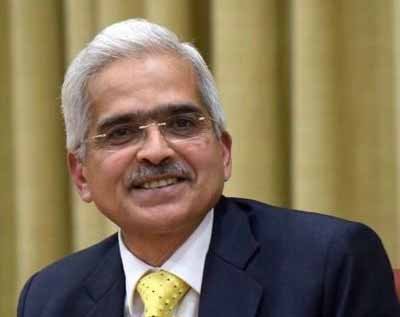

The MPC kept the Repo Rate at 4 per cent and the Reverse Repo Rate at 3.35 per cent, RBI Governor Shaktikanta Das announced after the three-day MPC meet on Friday. The Marginal Standing Facility (MSF) Rate and the Bank Rate too remained unchanged at 4.25 per cent. “MPC has decided to continue with accommodative stance until necessary to mitigate impact of COVID-19,” Mr Das said.

The RBI downgraded the Gross Domestic Product (GDP) growth forecast for FY22 to 9.5 per cent compared with 10.5 per cent earlier. The RBI’s action is in line with the consensus among economists about a status-quo in rates.

Inflation based on retail prices has remained above this medium-term target of 4 per cent for quite a long time now. In April, the CPI inflation came at 4.29 per cent compared with 5.52 per cent in March, backed by a fall in food prices. This is the fifth consecutive month that the Consumer Price Index (CPI)-based inflation is within the MPC’s target range.

On the other hand, growth is a bigger concern. The GDP contracted by 7.3 per cent in FY21. In the last policy review, the MPC had retained the GDP growth forecast for FY22 at 10.5 per cent. Recently, SBI economists had sharply cut their FY22 GDP growth estimates to 7.9 per cent from what was 10.4 per cent earlier.

Report By

View Reporter News