ECONOMY

5% GST on Zomato, Swiggy, petrol, diesel still out of the ambit of GST

- IBJ Bureau

- Sep 18, 2021

The GST Council, which met in Lucknow on Friday, decided on a number of issues, including getting online food-delivery operators, like Zomato and Swiggy, to pay 5 per cent GST on restaurant service. The decision-making body of the GST also decided not to bring petrol and diesel under its ambit for now.

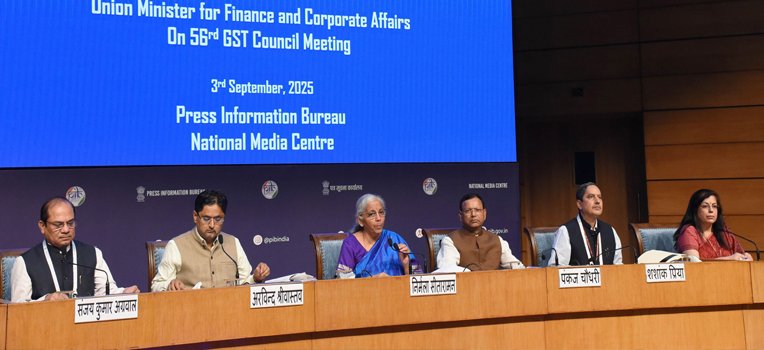

Addressing a press meet in the capital of Uttar Pradesh, Finance Minister Nirmala Sitharaman briefed the media on the various decisions taken by the GST Council. Ms Sitharaman clarified there was no new tax on online food-delivery operators. Instead, they would have to pay 5 per cent GST on restaurant service offered through them.

The finance minister added that these taxes would be charged at the time of delivery. This meant that the 5 per cent GST that was earlier paid by restaurants on food order would now be paid by the online food-delivery companies. The minor tweak was aimed at avoiding tax evasion, which in the case of restaurants was prevalent.

The finance minister said that the GST Council had decided against including petrol and diesel under the GST structure. “The GST Council felt it was not time to bring petrol and diesel under GST," Ms Sitharaman added.

Tamil Nadu had opposed the idea of bringing fuels under the GST. Justifying the opposition, Tamil Nadu Finance Minister P T Palanivel Thiaga Rajan said that petrol and diesel remained one of the last vestiges of a State’s right to manage its own revenue.

In a big relief to the airline industry, the finance minister said that Integrated Goods and Services Tax (IGST) on import of aircraft or other goods imported on lease would be exempted from “double taxation”.

“This will facilitate domestic industry and aviation sector, and these will also allow transfer of goods imported under lease without payment of IGST,” she added. The finance minister added that transport of exported goods by vessels and air had also been exempted from GST. “This was given due to difficulties being faced by exporters for getting Input Tax Credit (ITC) refund due to technical issues on GST Portal,” she said.

The minister added that GST had been exempted on muscular atrophy drugs, like Zolgensma and Viltepso, which cost crores of rupees. It also extended the period of concessional GST rates on certain COVID-related drugs by three months till December 31. However, the GST Council decided not to give the same benefit to medical equipment. The GST Council also recommended new footwear and textile rates from January 1.

Report By

View Reporter News