ECONOMY

RBI keeps policy rates untouched, introduces SDF, assures of accommodative stance

- IBJ Bureau

- Apr 08, 2022

The Reserve Bank of India (RBI) on Friday kept the benchmark interest rate, the Repo Rate – the rate at which the RBI lends to banks – unchanged at 4 per cent. The central bank also decided to continue with its accommodative stance despite rising inflation.

The MPC had decided to keep benchmark Repurchase (Repo) Rate at 4 per cent, Mr Das said while announcing the bi-monthly monetary policy review on Friday.

Consequently, the Reverse Repo Rate – the rate at which the RBI borrows from banks – will continue to earn 3.35 per cent interest for banks for their deposits kept with the RBI. This is the first MPC meeting of the current financial year.

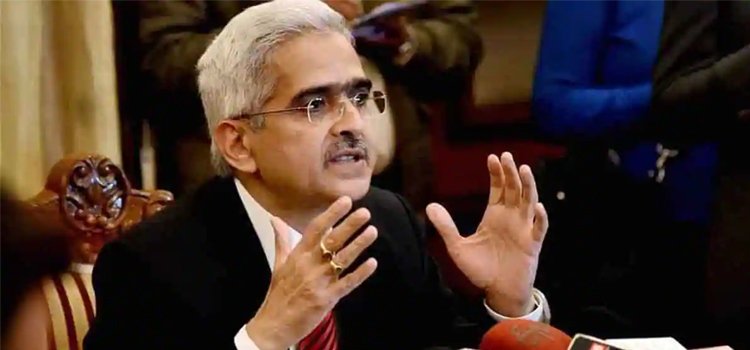

This is the 11th time in a row that the Monetary Policy Committee (MPC), headed by RBI Governor Shaktikanta Das, has maintained the status quo. The RBI had last revised its policy Repo Rate or the short-term lending rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting the interest rate to a historic low.

The RBI introduced the Standing Deposit Facility (SDF) – an additional tool for absorbing liquidity – at an interest rate of 3.75 per cent. The Standing Deposit Facility (SDF) will be an additional tool for absorbing liquidity without any collateral. The SDF, with an interest rate of 3.75 per cent, will replace the Fixed Rate Reverse Repo (FRRR) as the floor of the liquidity adjustment facility (LAF) corridor.

The policy panel slashed the GDP growth to 7.2 per cent from the earlier projected 7.8 per cent. It has also hiked the inflation forecast at 5.7 per cent for 2022-23 from the earlier rate of 4.5 per cent.

“Escalating geopolitical tensions have cast a shadow on our economic outlook. The war (Russia-Ukraine war) could potentially impede the economic recovery through elevated commodity prices and global spillover channels,” Mr Das said.

Report By

View Reporter News